Welcome back to another edition of Turnkey Tuesdays, your weekly dose of real estate reality. Buckle up, because this week’s ride through the housing market is full of twists and turns.

The Small-Time Investor’s Nightmare

First on our agenda is a sobering piece from The Wall Street Journal. It seems that the housing boom has turned into a bust for thousands of small-time investors. The dream of owning a rental property and securing a steady income stream has turned into a nightmare for many, as they struggle with vacancies, rising costs, and a saturated rental market.

This is a stark reminder that real estate investing, like any investment, comes with risks. But it also raises an interesting question: Are we placing too much emphasis on the “American Dream” of property ownership, at the expense of understanding the complexities and challenges of the market? Perhaps it’s time for a more nuanced conversation about what real estate investment really entails.

Moreover, this situation highlights the importance of diversification in investment. Just as you wouldn’t put all your eggs in one basket in the stock market, the same principle applies to real estate. Investing in different types of properties, in different locations, can help mitigate the risks associated with market fluctuations. And remember, real estate is a long-term game. Short-term setbacks can be painful, but they don’t necessarily spell disaster in the long run.

The Fed’s Rate Hike Pause

Next up, we have some news from the Federal Reserve. According to CNBC, the Fed’s Neel Kashkari has hinted that a pause in rate hikes in June doesn’t necessarily mean the end of the hiking cycle. This could have significant implications for mortgage rates and, by extension, the housing market.

But here’s a thought: Could this pause actually be a good thing for the housing market? It might give buyers a breather, allowing them to reassess their options and make more informed decisions. On the other hand, it could also create uncertainty, which is never good for market stability. It’s a delicate balance, and one that the Fed will need to manage carefully.

Furthermore, this pause in rate hikes could also have implications for the rental market. If mortgage rates remain high, more people might opt to rent rather than buy, which could boost demand for rental properties. On the flip side, higher mortgage rates could also increase the cost of financing for real estate investors, which could put a damper on the rental market. It’s a complex interplay of factors, and one that investors will need to monitor closely.

Hot Housing Markets

Now, let’s turn our attention to the hottest housing markets in April 2023, courtesy of Realtor.com. The list is dominated by midwestern metros, with cities like Columbus, Ohio, and Indianapolis, Indiana, leading the pack. It’s a testament to the enduring appeal of the Midwest, with its affordable housing, strong job markets, and high quality of life.

But let’s dig a little deeper. What’s driving this trend? Is it just the affordability factor, or are there other forces at play? Could it be that people are seeking a slower pace of life, away from the hustle and bustle of the coastal cities? Or is it theallure of the Midwest’s booming tech and healthcare sectors? Whatever the reasons, it’s clear that the Midwest is on the rise, and savvy investors would do well to take note.

Moreover, this trend could also be a reflection of the changing nature of work. With the rise of remote work, people are no longer tied to specific locations for their jobs. This could be leading to a redistribution of the population, as people move away from traditional job centers in search of a better quality of life. If this trend continues, we could see a significant shift in the dynamics of the housing market.

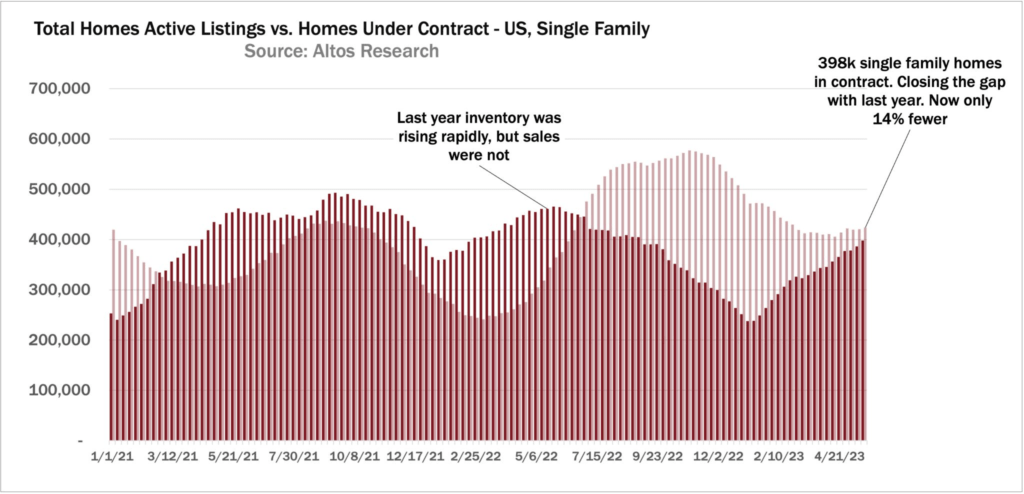

The Inventory Crunch

On to Redfin, where the story is all about low inventory. Despite a slight increase in new listings, the number of homes for sale remains near record lows. This inventory crunch is contributing to rising home prices and making it harder for buyers to find their dream homes.

But here’s a different perspective: Could this inventory crunch actually be a catalyst for innovation in the housing market? It might spur developers to explore new ways of building and delivering homes, such as modular construction or 3D printing. It could also encourage policymakers to rethink zoning laws and other regulations that restrict housing supply. In other words, this challenge could be an opportunity in disguise.

Furthermore, this inventory crunch could also be a sign of a more fundamental shift in the housing market. As people stay in their homes longer, and as new construction fails to keep up with demand, we could be moving towards a market characterized by lower turnover and higher prices. This could have significant implications for both buyers and sellers, and it’s something that anyone involved in the housing market should be keeping an eye on.

The Debt Ceiling Crisis

Over on LinkedIn, Michael Simonsen discusses the potential impact of the debt ceiling crisis on the housing market. If the crisis continues, mortgage rates could climb, and default rates could spike, freezing home buyers and potentially scaring sellers. It’s a grim scenario, but as Simonsen points out, the housing market has proven resilient in the face of past crises.

This raises an interesting point: The housing market is not an island; it’s deeply interconnected with the broader economy and political landscape. As such, it’s crucial for anyone involved in the market – whether as a buyer, seller, investor, or real estate professional – to stay informed about these broader trends and understand their potential impact on the housing market.

Moreover, this situation highlights the importance of fiscal responsibility, both on a personal and a national level. As individuals, we need to manage our debts responsibly and ensure that we’re not overextending ourselves. On a national level, our leaders need to manage the country’s debt in a way that promotes economic stability and growth.

Mortgage Forecasts

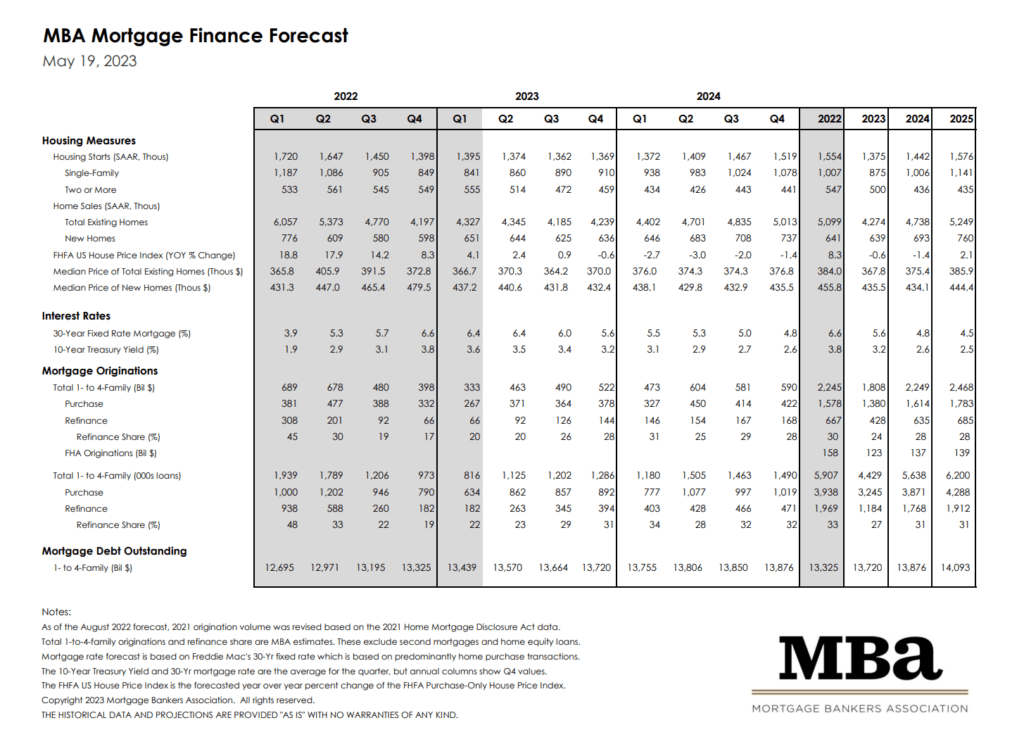

Finally, let’s take a look at the latest mortgage forecasts. The data suggests a decline in mortgage volumes, with the Mortgage Bankers Association predicting a significant drop in single-family originations. This could be another sign of a cooling housing market.

But let’s flip the script for a moment: Could this decline actually be a sign of a healthier, more sustainable market? After all, the housing boom of the past few years was fueled in part by historically low mortgage rates, which may not have been sustainable in the long run. A return to more normal levels could help prevent a housing bubble and ensure the long-term stability of the market.

Moreover, this decline in mortgage volumes could also be a reflection of changing consumer behavior. As people become more cautious in the face of economic uncertainty, they may be choosing to delay major purchases like homes. This could lead to a slowdown in the housing market, but it could also lead to a more balanced and sustainable market in the long run.

Wrapping Up

So, what’s the takeaway from all this? Well, the housing market is as dynamic and unpredictable as ever. But it’s also full of opportunities for those who are willing to look beyond the headlines and think critically about the underlying trends and forces at play.

That’s it for this week’s Turnkey Tuesdays. Stay tuned for more insights, updates, and witty banter about the wild world of real estate. Until then, keep those property dreams alive!